Lucid Dreaming VI: AI Field Notes

Our GP Srecko reports on his learnings on AI in the field with 100s of LPs, Enterprises and Founders

Over the past several months, we’ve had discussions with over 100+ LPs, enterprises, and operators who are either involved in, investing in, or currently navigating the challenges posed by AI within their organizations.

The outcomes of these conversations yielded unexpected findings. Check out our field notes.

Generative AI is everywhere… not ❌

Working as an investor, everywhere you look you see what feels like an explosion of Generative AI

While the enthusiasm within the realms of Twitter and LinkedIn is palpable, its manifestation in the actual business landscape paints a different picture: 3/4 of the companies we engaged with have yet to embrace any AI applications.

Attitudes tend to fall into two camps

GenAI is very interesting but we are just starting to think about it (i.e. thinking about potential use-cases)

GenAI is very interesting but if we cannot deal with the downsides, we are banning it

Main concerns currently center around governance questions (who owns data, where is it sent to…) as well as the potential for model ‘hallucinations’ yielding incorrect results

Interestingly, this was even true for two growth-stage fintechs we talked to: given security concerns, they outright banned usage of any LLM application (…Compliance solved!)

Another company started to deploy prompts but only after a member of the leadership team signed off on every single prompt manually (yes, every prompt)

We observed the emergence of the first Enterprise-grade solutions (compliant LLMs apps with cost controls) and a more sophisticated LLM-Ops stack

What to do with all the tooling? 🛠

We note the proverb: “During a gold rush, sell shovels”

While we agree with this statement (see Nvidia), what we hear from potential adopters is that there is an abundance of infrastructure in certain areas but too few people left knowing what to do with it

We had two conversations with LPs who complained that they get approached by dozens of people every week with tooling but nobody with solutions to their actual problems

Others feel quite confused about where to start their journey and who to talk to

One Mid-Market player even engaged a university-affiliated AI lab to figure out their first steps

Where we currently see adoption is companies solving for a very specific and deep enough use case (e.g. vertically integrated “Copilot”), and founders selling horizontal tooling (esp. in the Enterprise space) focusing on 1-2 specific use-cases

A strong service-led approach (e.g. a Palantir for Enterprise Segment) might make sense given the sheer size of the opportunity we observe

Enterprise AI: An army of agents 🕵️♀️

We have had several discussions about where AI will add value: will it be through vertical applications that improve existing processes, or will it come from many small, incremental steps that accumulate at scale?

Many discussion partners are curious about how they can make their knowledge workers just 20% more effective in every task they undertake: think of writing emails, drafting documents, following up on leads, looking up market reports, submitting travel expenses

This aligns with a new wave of startups that are creating an "App-Store" of Agents for Enterprise, or those who are developing agents using an Adam-Smith-like invisible hand (adept.ai, character.ai), as opposed to focusing on specific vertical solutions

It is remarkable to see the impact some of these agents can have for use-cases that wouldn’t justify a standalone product

For example, we heard about a large recruiting operation that built an agent to summarize and write "Briefs" based on people's LinkedIn profiles, which they then present to their clients

What may seem like a small and insignificant task actually results in significant savings, with 20,000 profile briefs being written every month across the company

Despite the risk of incumbents incorporating this technology into their existing offerings (e.g., Google integrating it into GDrive), we observe exciting developments in the area

Adoption mainly driven by cost savings today 💰

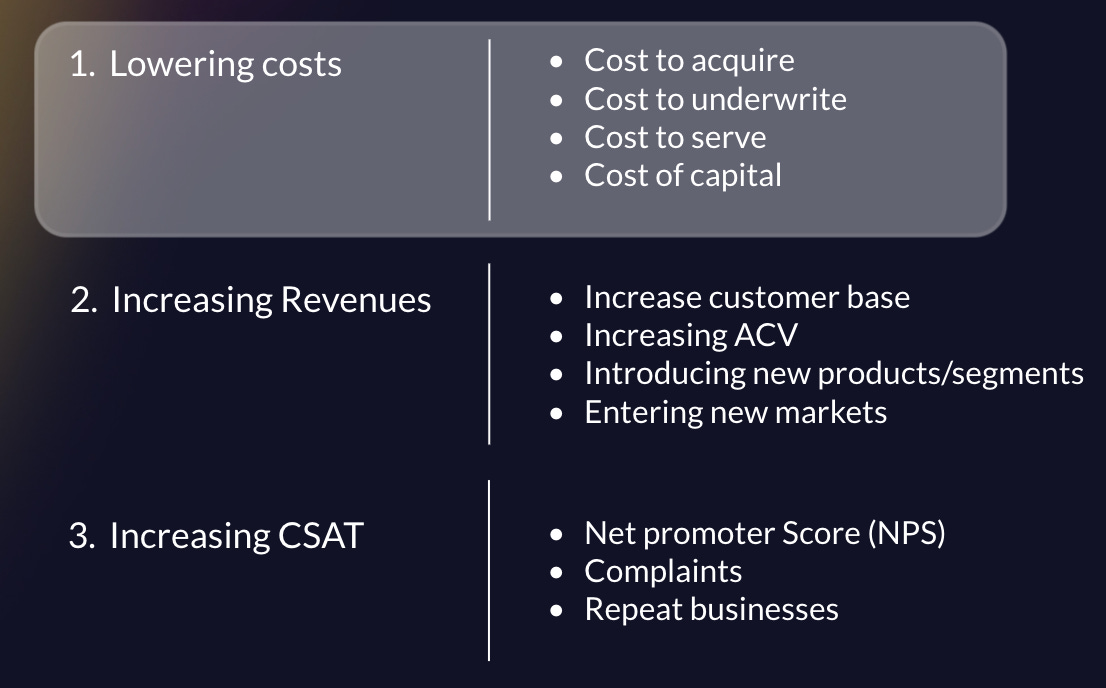

More than 50% of the people we talked to are actively looking for AI tools to drive down costs. Revenue-optimization and customer satisfaction are less of a priority at the moment

This is in line with the cadre of startups emerging in the field, and is understandable given the economic environment we are currently in

An emerging theme in discussion is that many mention AI as a potential lever in addressing the issue of labor shortages, which next to energy prices and bureaucracy is a major pain point for Europeans

This is especially true in back office functions where companies struggle to hire: we had one partner saying they have been looking for 3 open accounting roles now for more than 16 months

GenAI should here work comparatively well for professions with codified rules (taxes, compliance, accounting)

Buying personas differ vastly 🙋♀️

One of the most important questions we ask every founder is: who are you selling to?

For AI-native tools, that’s not easy to define: almost all people we talked to have not assigned overarching responsibility for AI topics within their respective organisation

In most cases, department heads somewhat autonomously allocate budgets and there is no central function like a CTO or CIO that is responsible for an AI strategy, rather than single engineers or squads/teams working on specific issues within the department

A handful of companies have started forming task-forces to analyse use cases and centrally steers initiatives to centrally map out processes

We believe this underlines the importance of building tools that clearly address a specific use-case and persona, which will significantly improve any GTM motion

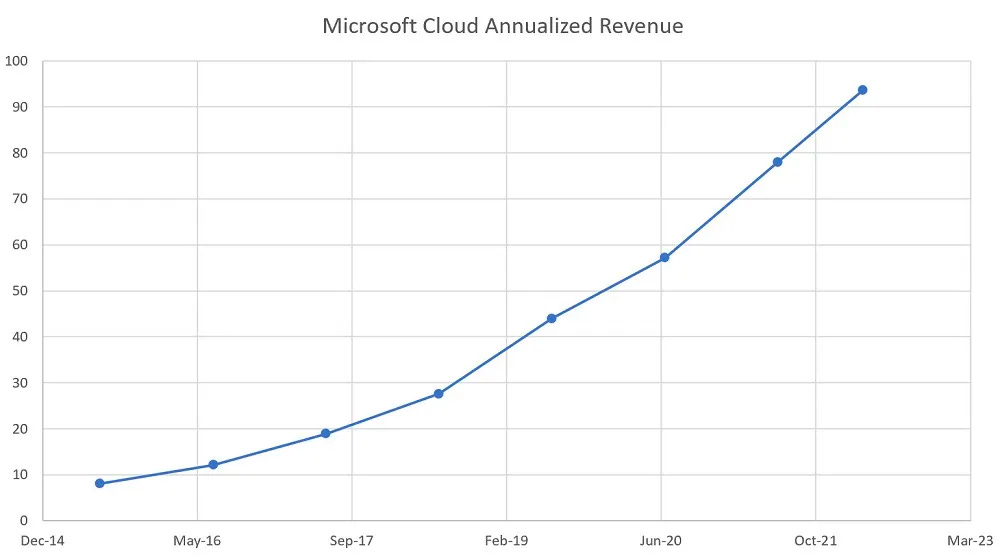

The winner of the AI race on the customer front is Microsoft ⬆️

All but one of the enterprise companies we talked to have been actively approached by Microsoft or connected Partners with their AI offering in hand

Microsoft has played their AI hand well and we expect them to push even further given their worldwide distribution advantage

Mid-Market companies trust Microsoft and from the conversations the argument around peace of mind outweighed potential concerns around dependencies on one partner, which some VCs have raised as an argument for platform-independent startups

However, many want to see “what is out there” before taking a major buying decision, especially if a large budget is involved

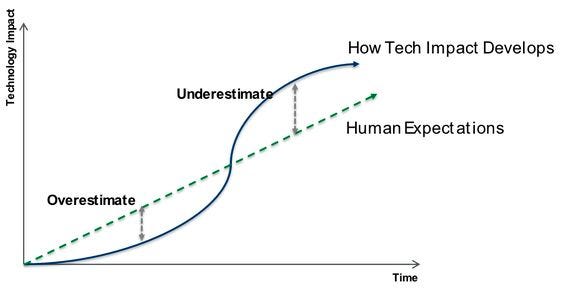

Real world impact will take longer than expected ⏳

Discussion around the impact of LLM on actual businesses shows that we are slowly reaching the peak of the hype cycle: leaders have understood the impact and are planning how to act

Most leaders expect this to be a marathon and not a sprint, and are thinking actively about potential organisational impact

This reflects our conviction that impact will be large in the long-term, but overestimated in the short term

At Lucid, we are eager to support the next generation of transformative AI companies and are in active discussions with top operators in the field. If you happen to know anyone we should connect with or want to talk about Gen AI and LLMs, please feel free to reach out!